The Restricted Obligation Company (LLC) stands out as a prominent selection due to its versatility and security features when it comes to service frameworks in the United States. An LLC distinctively integrates the pass-through taxes of a partnership or single proprietorship with the limited responsibility of a firm. This means that the business's earnings are strained just when at the private level, bypassing the dual taxes often related to firms. LLC owners, referred to as members, can be individuals, corporations, other LLCs, and even international entities. There is no optimum variety of members, and a single member can possess an LLC, making it a flexible option for services of all dimensions.

One of the main factors for the appeal of LLCs is the legal protection they offer. Members of an LLC are safeguarded from personal liability for company financial debts and cases-- a feature recognized as "restricted responsibility." This defense implies that when it comes to bankruptcy or lawsuits, the individual possessions of the participants, such as personal financial institution accounts, homes, and other investments, are generally not in danger. It's essential to note that this guard is not absolute. The "business shroud" can be pierced if the business is discovered to have actually been operating fraudulently or without the correct splitting up from the personal transactions of its members. Maintaining the appropriate lawful and financial separations is crucial for keeping the protections of an LLC undamaged.

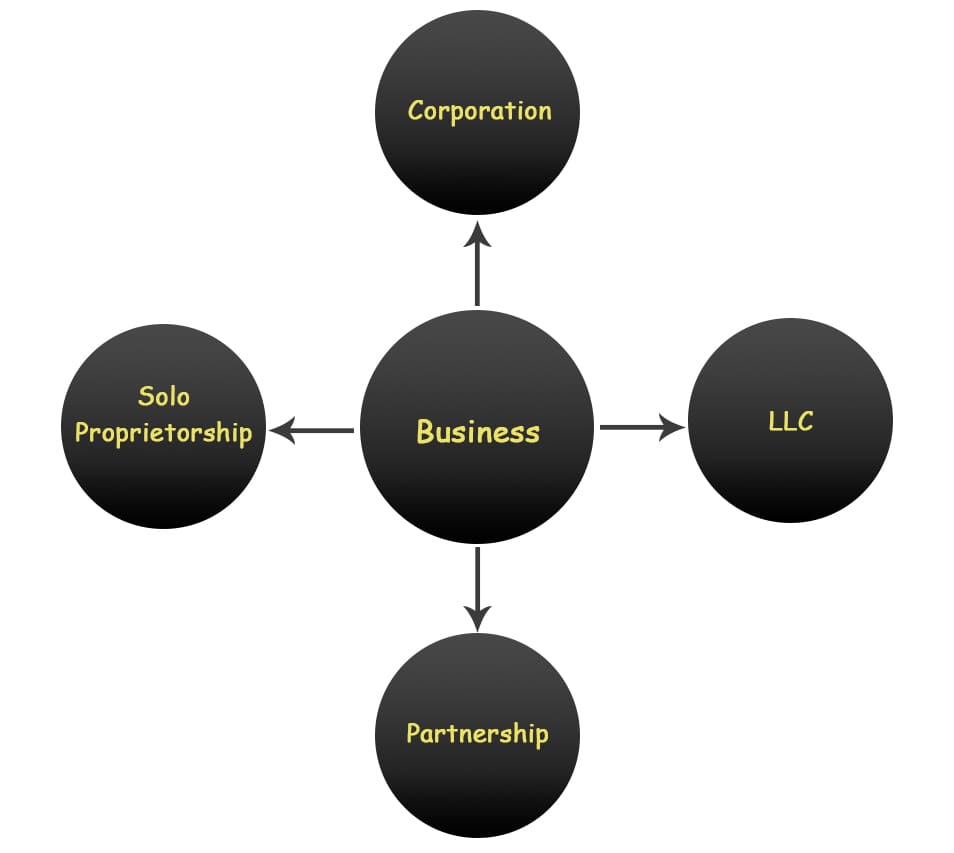

Understanding Limited Responsibility Companies (LLCs)

A Limited Liability Company (LLC) is a prominent organization structure amongst business owners throughout different industries because of its versatility and protective features. Basically, an LLC is a hybrid entity that integrates the pass-through taxation of a partnership or sole proprietorship with the restricted responsibility of a firm. This implies that the revenues and losses of the business can be passed directly to the owners, referred to as members, who then report them on their individual tax returns, therefore preventing the double taxes usually linked with companies. Furthermore, among the most attractive aspects of an LLC is the restricted obligation protection it offers. This protection indicates that members are generally not directly responsible for the debts and obligations of business. Should the LLC face personal bankruptcy or suits, the individual assets of the members, such as their homes, vehicles, and various other individual possessions, are usually shielded.

The adaptability of an LLC additionally prolongs to its management structure. Unlike firms that are needed to have a board of directors and corporate policemans, LLCs can be handled by the participants or by managers that may not be members. This allows the LLC to either be member-managed, where all members get involved in the decision-making procedures of the business, or manager-managed, where only marked managers (that can be outsiders or members) manage the daily procedures, leaving the participants as passive financiers. This can be particularly advantageous in situations where the participants like not to be included in the daily affairs of business.

In addition, establishing up an LLC is normally less complex and requires much less documents than forming a company. The main paper needed to develop an LLC is the Articles of Organization, which need to be filed with the appropriate state agency together with any kind of called for declaring charges. This document commonly includes basic info such as the name of the LLC, its major business address, and the get in touch with details for its registered representative, that is licensed to get legal documents in support of the LLC. Each state might have different needs and policies concerning LLCs, so it is essential for prospective entrepreneur to recognize the certain laws in their state.

An additional substantial aspect of LLCs is their adaptability in regards to membership. There is no optimum number of participants, and participants can consist of individuals, various other LLCs, corporations, and also foreign entities in many cases. This makes it a highly versatile choice for organizations that could intend to increase or diversify their ownership structure in time. However, the adaptable nature of an LLC can also result in complexities, specifically when it comes to the administration of bigger LLCs or those with a varied participant base. It is essential for such entities to have a well-drafted Operating Agreement in location. This contract lays out the legal rights and duties of the members, the appropriation of revenues and losses, and the procedures for making decisions regarding business. The Operating Agreement is an internal document and does not need to be submitted with the state, however it is an essential tool for avoiding disputes amongst participants and managing the LLC efficiently.

Understanding Restricted Liability Business (LLCs): Structure and Benefits

Limited Obligation Firms (LLCs) are a preferred choice for entrepreneur looking for versatility and security from personal obligation. This service structure incorporates the pass-through tax of a collaboration or sole proprietorship with the restricted liability of a firm, making it an attractive option for several entrepreneurs. One of the vital advantages of an LLC is that it safeguards its participants' personal assets from business debts and claims-- a feature that is not readily available in sole proprietorships or traditional collaborations. Members of an LLC are only accountable for organization financial debts to the level of their financial investment in the business. Additionally, LLCs are known for their adaptability in administration and operation. Unlike firms, LLCs do not require a board of supervisors, shareholder conferences, or other managerial rules, which allows for even more straightforward governance tailored to the specific requirements of the service proprietors. Additionally, LLCs provide substantial versatility in terms of tax therapy. They can pick to be tired as a sole proprietorship, partnership, or firm, offering calculated choices for decreasing gross income and enhancing economic outcomes. This flexibility in tax standing can be particularly advantageous throughout different phases of the company life cycle. Besides these advantages, establishing up an LLC is typically less complex and less expensive than forming a firm, and it frequently requires much less documentation and less ongoing formalities, which can be a substantial benefit for tiny to medium-sized services. Ultimately, the decision to develop an LLC needs to be based on a careful analysis of the certain requirements and objectives of business, in addition to the lawful implications and management duties that include this kind of structure.

Comprehending the Framework and Advantages of an LLC

Limited Obligation Companies (LLCs) provide a flexible company framework that incorporates the pass-through tax of a collaboration or sole proprietorship with the limited liability of a corporation. secret info makes LLCs an attractive choice for numerous entrepreneurs. Essentially, an LLC secures its proprietors, who are frequently referred to as members, from individual liability in most circumstances, suggesting individual properties like cost savings, homes, and vehicles are protected from business financial debts and insurance claims. LLCs are relatively easy to establish up and keep with fewer compliance needs compared to companies. Participants can include people, companies, various other LLCs, and foreign entities, without any maximum number on membership. Among one of the most appealing features of an LLC is the versatility in monitoring. Unlike firms, which are called for to have a board of directors and company policemans, LLCs can be managed by the participants or by supervisors who may not be members. This gives a double structure possibility where the LLC can be member-managed, which is analogous to a collaboration, or manager-managed, which more carefully appears like a corporation, enabling members to be easy financiers. Taxation is an additional location where LLCs provide convenience. By default, LLCs are dealt with as pass-through entities for tax obligation objectives, meaning that business itself is not strained. Instead, revenue is gone through to the members and reported on their individual tax obligation returns. An LLC can likewise pick to be exhausted as a firm if that is extra valuable. The capability to change the monitoring framework and the taxes design supplies significant flexibility for service preparation and economic monitoring. The production of an LLC also normally includes preparing an operating agreement, which is a key paper that describes the administration of the LLC and the circulation of losses and revenues. This contract enables participants to structure their financial partnerships in such a way that best fits their business requirements and objectives, supplying a clear protocol for managing disputes, circulations, and the enhancement or separation of members.

Comprehending the Versatility and Tax Advantages of an LLC

The Limited Obligation Firm (LLC) is a prominent service structure among entrepreneurs due to its versatility and significant tax advantages. An LLC uniquely incorporates the characteristics of both company and partnership or single proprietorship, depending upon exactly how it is structured. This flexibility allows LLC owners, commonly referred to as participants, to gain from the pass-through taxation of a partnership or sole proprietorship, while additionally enjoying the minimal responsibility functions of a corporation. Essentially, this implies that any earnings earned by the service are passed straight to members and reported on their individual tax returns, therefore preventing the double taxes typically connected with corporations. Additionally, members can make a decision each year whether to maintain their pass-through tax status or, alternatively, to be strained as a various sort of entity. This versatility in taxation not only streamlines the tax declaring process but likewise enhances tax results for the members based on the changing financial landscapes or business goals. Along with tax benefits, the framework of an LLC offers a layer of defense for participants' individual properties from service financial debts and cases. Unlike in sole proprietorships or partnerships, where proprietors' individual assets can be taken to cover service financial debts, an LLC makes certain that only company possessions go to threat in such circumstances. This defense is paramount in supplying comfort for entrepreneurs, enabling them to take computed business threats without the hazard to their individual economic security. The functional versatility of an LLC also encompasses its monitoring; whereas firms are called for to have a board of supervisors and business policemans, an LLC does not require such procedures and can be taken care of by its participants or appointed managers. This much less inflexible functional structure makes it less complicated for tiny to medium-sized businesses to adapt swiftly to modifications and handle their operations more fluidly. Taken with each other, these attributes make the LLC an appealing choice for many entrepreneur searching for a mix of simpleness, defense, and versatility.